A recent surge in purchase activity indicates that the early spring real estate market is in full swing in our region. Fluctuating interest rates have caused some buyers to converge on properly-priced listings when rates are down, while potential sellers have been hesitant to let go of the historically low mortgages they have on their homes. This has led to a well-known dynamic in our region: not enough inventory to meet the current demand, causing buyers to compete again in multiple offer scenarios. The likely effect of this push-pull will be higher prices in the coming months, despite the constraints of higher (and unpredictable) mortgage rates.

The current interest rate environment is the difference between the level of competition the market is experiencing now and the frenzy of the pandemic market. Buying power is lessened by higher mortgage payments and, with rates still in flux, creative financing is key for many buyers.

That being said, Windermere’s Chief Economist Matthew Gardner notes that buyers are eager to take advantage of brief dips in rates when they do appear. “What is interesting is that home prices rose between January and February, which tells me that buyers jumped on the opportunity to take advantage of mortgage rates that dipped below 6.1% five times between mid-January end early February,” Gardner said.

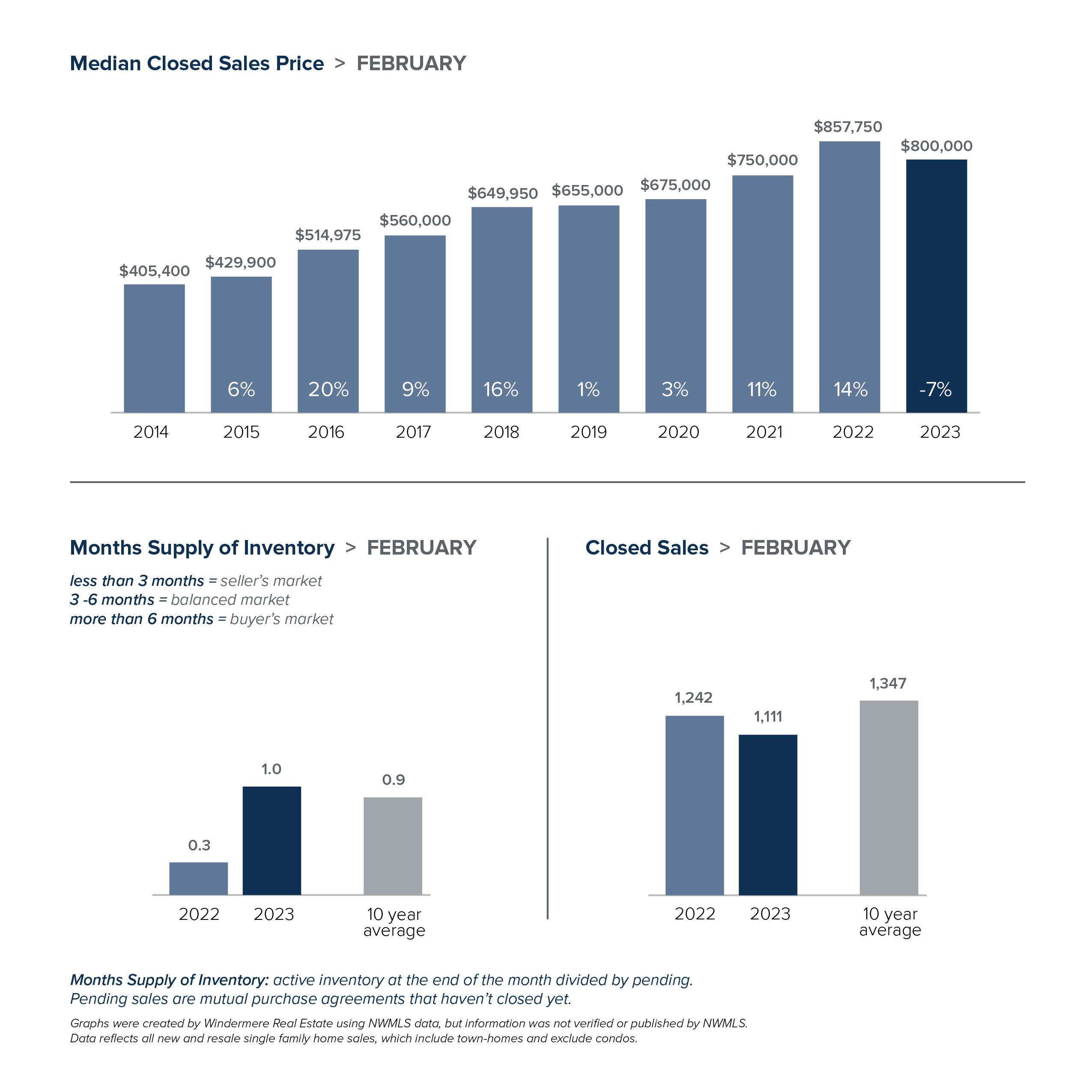

In King County, single-family home prices did rise from $781,098 in January to $800,000, though that’s down 6.7% from $857,750 in February 2022. Condos were also up, with a median price of $468,500 last month compared to $450,000 in January.

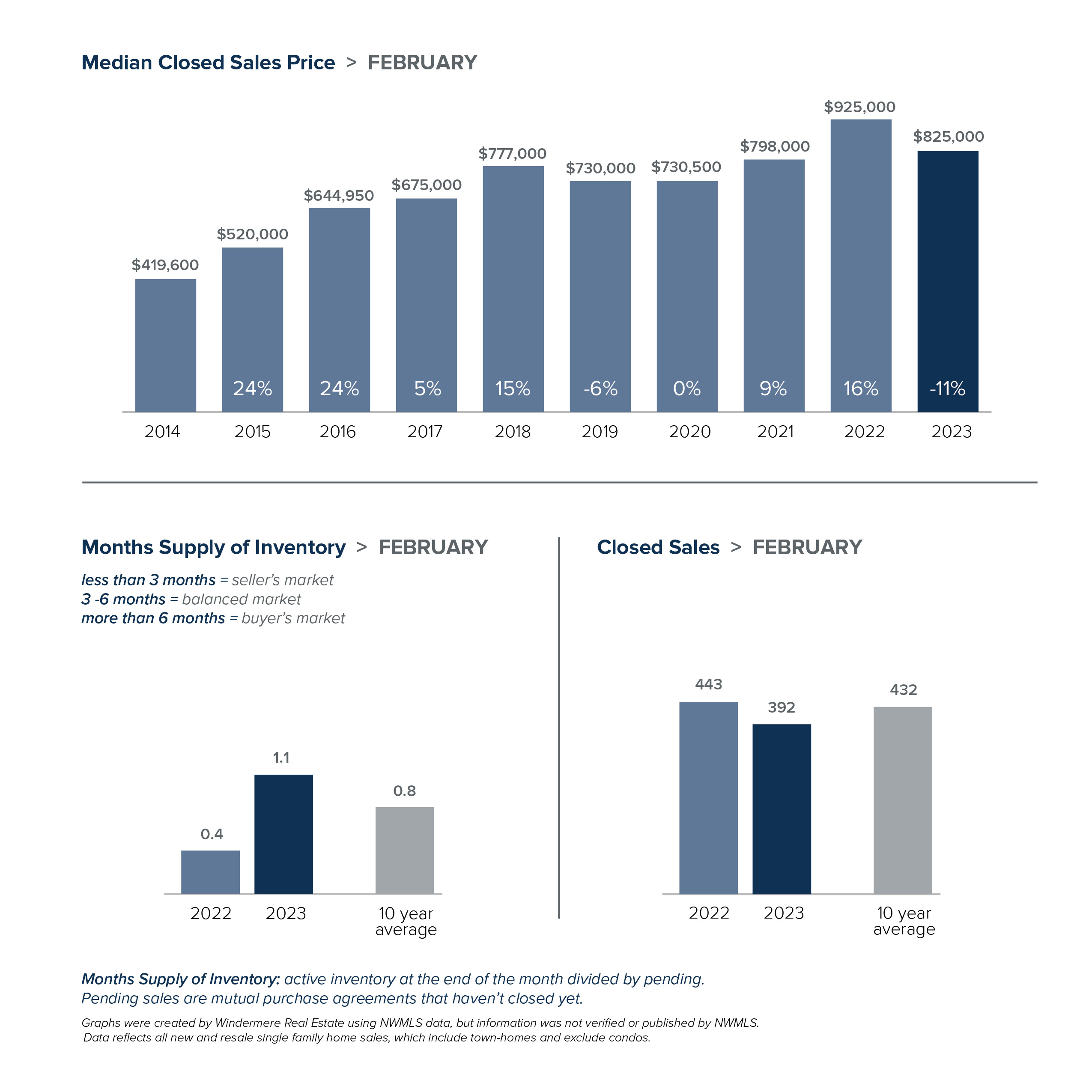

Seattle followed much the same pattern, with the median price of single-family homes rising from $803,750 in January to $825,000 last month. While that is still down 11% from $925,000 this time last year, interest rates have played a large part in what buyers can reasonably afford. In the last two years alone, the median interest payment for a single-family home has risen 54%, from $3,283 in February 2021 to $5,085 — an increase of $1,802. Despite this, demand is still high, as buyers do what they can to break into the market. In February, 28% of Seattle homes sold above list price, and 53% of listings sold in under two weeks.

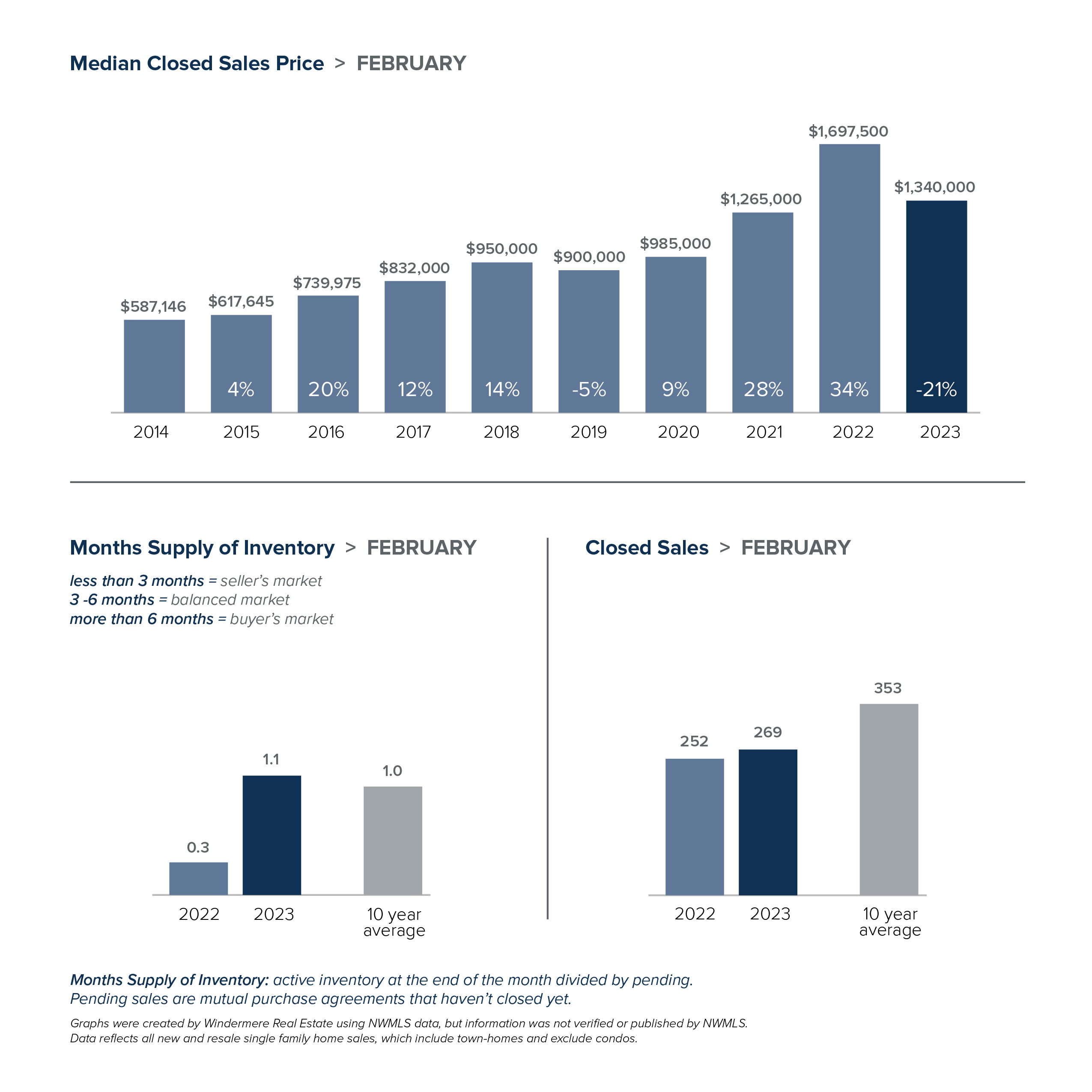

On the Eastside, the median price of a single-family home last month was $1,340,000 — down over 21% from a year ago, when the median was $1,697,500. However, February sold prices were up from January, when the median was $1,320,000. A sure sign that the Eastside market is becoming more competitive, in the last three months both the number of homes selling above asking price and the amount over list price have doubled.

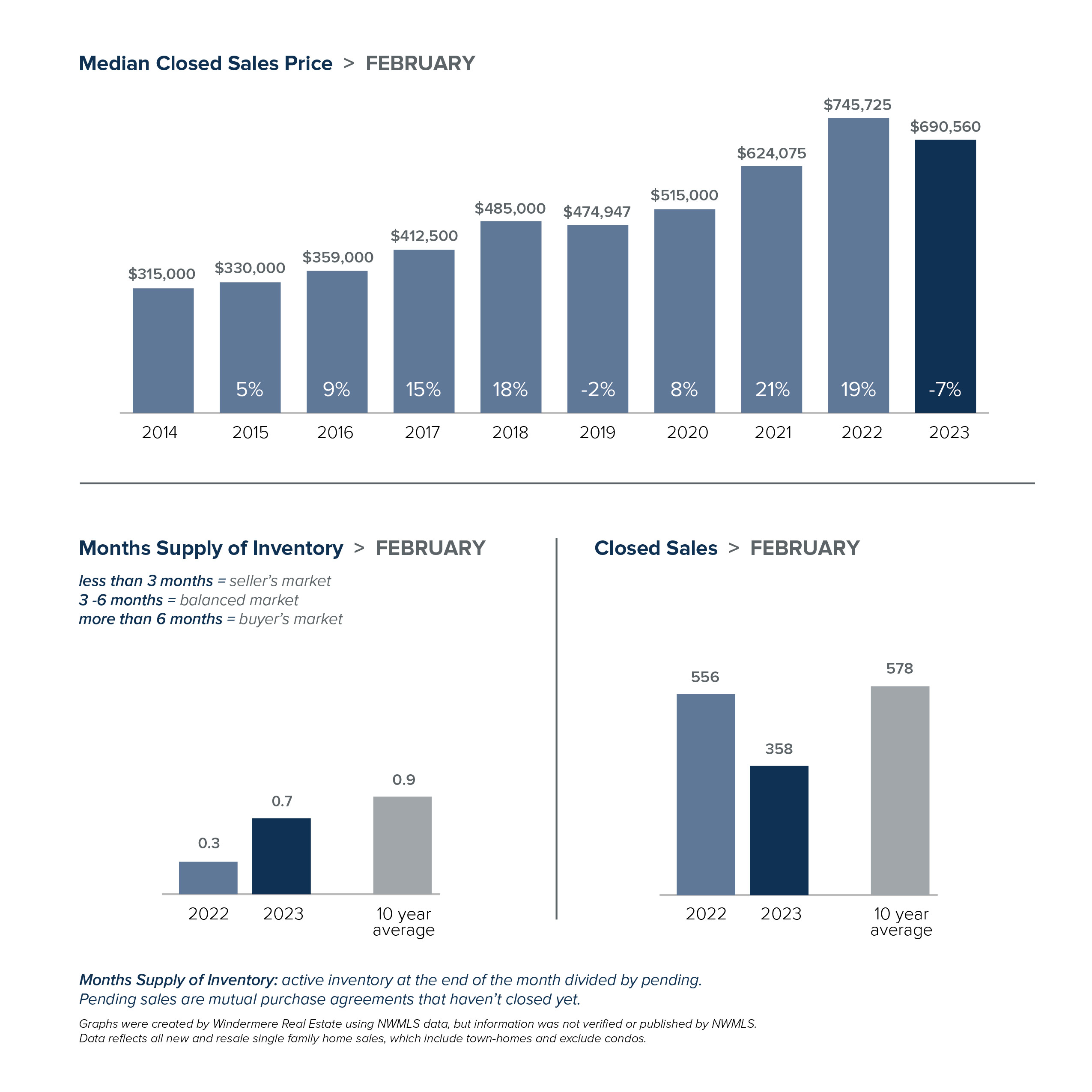

In Snohomish County, the median price for single-family homes fell 7.4% year-over-year to $690,560. Unlike the other regions, that’s also down from January’s median price of $699,000. The higher interest rates could be causing more buyers in this market to pause as they wait for prices and rates to stabilize. The relative affordability of Snohomish County has long been a draw for many buyers, who now may be more sensitive to the fluctuations of the market.

Looking ahead, Matthew Gardner predicts we will see more of the same trends. “Year over year, home sales prices are down, but that isn’t surprising given that a year ago homebuyers were scrambling to buy in the face of mortgage rates that were about to skyrocket,” he said. “I expect we will see a similar story for the next few months.”

If you have questions about what these market conditions mean for you, please reach out to your Windermere broker.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link